Corporate Tax Penalty Waiver in the UAE: Here’s What Businesses Should Know in 2025

Find out how your company can take advantage of the UAE FTA corporate tax penalty waiver program in 2025. Singiri Auditing. takes you through the eligibility, timeframes and the subsequent steps towards complete compliance.

The Federal Tax Authority (FTA) has decided in a positive step aimed at assisting businesses throughout the UAE to waive penalties of those who failed to observe their corporate tax registration deadline. It is a very important initiative as it will give the businesses a chance to fix their compliance situation and to evade a financial penalty, should they do it within the stipulated period.

At Singiri Auditing, we make tax regulations a breeze to any business. Our team of experts keeps you abreast of all the new FTA guidelines such as the new corporate tax penalty waiver regulations which are set to be introduced in the 2025 financial year.

Understanding the UAE Corporate Tax Regime

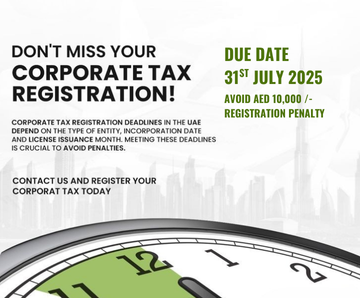

In the UAE, corporate tax was in an intellectual property introduced through Federal Decree Law No. 47 of 2022 and applies to financial years starting on or after 1 June 2023. According to the Cabinet Decision No. 10 of 2024, a fine of AED 10,000 will be charged on those businesses which do not register with corporate tax within the timeframes stipulated by the FTA.

But with the new relief regime, those businesses that make registration and returns within seven months of the initial tax period can get the waiver of the penalty even where the penalty has already been imposed or paid.

Who is Eligible for the Penalty Waiver?

The following are the categories of businesses that would be eligible to the waiver:

- Registered and unpaid penalty: In case you have registered late and have been penalized but have not yet paid the penalty, you can evade the penalty by filing your tax within seven months after the end of your first tax period.

- Registered and penalty already paid: When the penalty has been paid and tax returns have been filed within the time, the amount of penalty will be refunded back to your tax account.

- Still not registered: Provided your business has not yet filed the corporate tax registration, there is still a chance to avoid penalties by registering and submitting your return within seven months after the expiry of your first tax period.

- Exempt businesses: Even the exempted entities need to make an annual declaration during the same period to be on the right side of compliance.

Why this will be important in 2025

The year 2025 represents a significant control point to most of the UAE-based companies, particularly those whose initial tax periods will expire in the year 2024. As the enforcement increases, a lack of compliance may result in financial loss and reputational risk. The waiver window is a short-duration chance to match tax laws and dodge punishment – and potentially recover sums that have already been paid.

How Singiri Auditing. Can Help

The tax specialists at Singiri & Co. are willing to:

- Check your registration status and initial tax period

- Register and lodger your corporate tax effectively

- Exempt business guide annual filing of declarations

- FTA Penalty reversals or refunds liaison.

Our team offers comprehensive assistance in corporate tax compliance so that your business is not subjected to avoidable fines and at the same time it keeps appropriate records and deadlines.

Take Action Today

Did your business fail to register on time or did you get a late penalty notice? Then this is your chance to take action. By having Singiri Auditing. as your advisory partner, you will go through this transition with ease and certainty.

Get in touch, singiriandco@gmail.com, or check our Corporate Tax Services page to find out more.

Suggested Internal Links: