Table of Contents

What Are Accounting Principles?

Accounting Principles Explained are the rules that guide how financial transactions are recorded, reported, and interpreted. Following Accounting Principles Explained ensures that financial statements are accurate, consistent, and easy to understand. Standardized frameworks like GAAP and IFRS are part of Accounting Principles Explained, providing guidance that businesses worldwide follow to maintain credibility and compliance.

These principles help stakeholders, including investors and management, make informed decisions. They also promote transparency and trust in financial reporting. By applying Accounting Principles Explained, companies can present a true and fair view of their financial health.

Why Accounting Principles Matter

- Provide rules for recording and reporting financial transactions.

- Ensure accuracy, consistency, and transparency in financial statements.

- GAAP and IFRS are standard frameworks used globally.

- Help stakeholders make informed financial decisions.

- Promote trust and credibility in business reporting

Key Accounting Principles

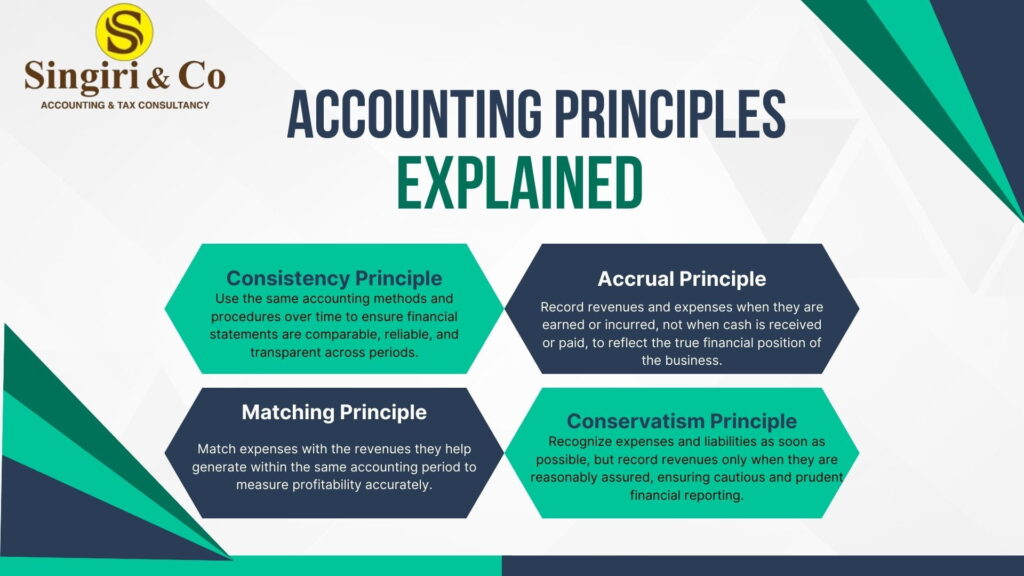

1. The Accrual Principle

The accrual principle states that revenue and expenses should be recorded when they are earned or incurred, regardless of when cash is actually received or paid. This principle ensures that financial statements reflect the true financial performance of a business during a specific period, rather than just tracking cash flow.

Example: A company provides consulting services in December but receives payment in January. According to the accrual principle, the revenue should be recorded in December, when the service was performed, not in January when the payment is received. Similarly, if the company receives a bill for electricity used in December but pays it in January, the expense is recorded in December.

2. The Consistency Principle

The consistency principle requires a business to use the same accounting methods from one period to the next. This ensures that financial statements are comparable over time and that financial trends can be analyzed accurately. By maintaining consistent accounting methods, businesses provide reliable and understandable financial information to stakeholders, including investors, management, and regulators.

Example: If a company uses the straight-line method for depreciation in one year, it should continue using the same method in future years. Changing the method frequently could make it difficult to compare financial results between periods and may lead to confusion or misinterpretation

3. The Going Concern Principle

The going concern principle assumes that a business will continue to operate indefinitely and will not be forced to liquidate its assets in the near future. This assumption allows companies to record assets and liabilities based on their intended long-term use rather than their immediate liquidation value. It also affects financial reporting, including depreciation, amortization, and inventory valuation, providing a more realistic view of a company’s financial position.

Example: A company owns machinery purchased several years ago. Under the going concern principle, the machinery is recorded at its historical cost and depreciated over its useful life rather than being valued at what it could be sold for today. This ensures accurate reporting and reflects the ongoing operations of the business.

4. The Prudence (Conservatism) Principle

The prudence principle, also known as the conservatism principle, advises businesses to avoid overstating income or assets and to recognize expenses and liabilities as soon as they are reasonably foreseeable. This ensures that financial statements present a realistic and cautious view of a company’s financial position, preventing overly optimistic reporting. It helps stakeholders make decisions based on reliable and conservative information rather than inflated figures.

Example: If a company is involved in a lawsuit that may result in a loss, the potential expense should be recorded immediately. However, a possible gain from the lawsuit should only be recognized when it is certain. This approach ensures financial statements remain realistic and trustworthy.

5. The Matching Principle

The matching principle requires that expenses be recorded in the same accounting period as the revenues they help to generate. This ensures that profit calculations are accurate and reflect the true performance of a business during a specific period. By matching related revenues and expenses, financial statements provide a clearer picture of profitability and operational efficiency.

Example: A company sells products in December but receives the shipping invoice in January. According to the matching principle, the shipping expense should be recorded in December, along with the revenue from the product sale. This ensures that the profit for December accurately reflects all related costs and revenues.

6. The Materiality Principle

The materiality principle states that only information that is significant and could influence the decisions of stakeholders needs to be fully disclosed in financial statements. Minor or insignificant items can be ignored if they do not affect the overall financial picture. This principle helps businesses focus on reporting important information while keeping financial statements clear and relevant.

Example: A company spends a small amount on office supplies. Since this amount is not significant in relation to the overall financial statements, it can be expensed immediately rather than being tracked in detail. This allows stakeholders to focus on material items that impact decision-making.

7. The Cost Principle

The cost principle requires that assets be recorded in the financial statements at their original purchase cost rather than their current market value. This ensures that the information is reliable, objective, and verifiable. By using historical cost, businesses avoid subjective valuations and provide consistent financial reporting over time.

Example: A company purchases machinery for $50,000 five years ago. Even if the market value of the machinery has increased to $70,000, it is recorded on the books at the original purchase price of $50,000. This approach ensures accuracy and consistency in financial reporting.

8. The Revenue Recognition Principle

The revenue recognition principle states that revenue should be recorded when it is earned, regardless of when the cash is actually received. This ensures that financial statements accurately reflect the business’s performance during a specific period. By recognizing revenue when earned, companies provide a true picture of their financial results and avoid misleading stakeholders.

Example: A company completes a consulting project in December but receives payment in January. According to the revenue recognition principle, the revenue should be recorded in December, when the work was completed, not in January when the payment is received. This provides an accurate view of the company’s performance for December.

9. The Full Disclosure Principle

The full disclosure principle is a key part of Accounting Principles Explained. It states that financial statements should include all information that could affect the decisions of users, such as investors, creditors, and regulators. By applying Accounting Principles Explained, businesses ensure transparency and provide a complete view of their financial position, enabling stakeholders to make informed decisions. Following this principle helps maintain trust and credibility in financial reporting.

Example: If a company is involved in a pending lawsuit or has significant contractual obligations, these should be disclosed in the notes to the financial statements. Using Accounting Principles Explained, stakeholders can understand potential risks and make well-informed decisions based on complete information.

Common Mistakes to Avoid

Many businesses face serious consequences when accounting mistakes occur. Accounting Principles Explained help prevent errors such as ignoring accruals and deferrals, which can misstate profits and lead to poor financial decisions. Accounting Principles Explained guide proper separation of personal and business transactions, avoiding inaccurate reporting and potential legal issues.

Following consistent Accounting Principles Explained ensures performance can be accurately compared across periods, keeping investors informed. Applying Accounting Principles Explained also ensures all transactions are recorded promptly and properly documented, reducing the risk of incomplete financial statements and audit problems.

Potential Risks:

- Misstated profits or losses affecting decision-making.

- Loss of investor trust and credibility.

- Regulatory penalties or compliance issues.

- Difficulty in tracking business performance over time.

- Increased risk of errors during audits

Conclusion

Accounting Principles Explained form the foundation of accurate, transparent, and reliable financial reporting. Accounting Principles Explained ensure that businesses present a true picture of their financial performance and position, enabling stakeholders to make well-informed decisions.

By understanding and consistently applying these Accounting Principles Explained, businesses can avoid common mistakes, maintain credibility, comply with regulations, and build trust with investors, creditors, and other stakeholders. Applying Accounting Principles Explained effectively supports better financial planning, improves decision-making, and contributes to the long-term success and stability of a business.

(FAQS)

1.What are accounting principles?

Accounting principles are the rules and guidelines that govern how financial transactions are recorded, reported, and interpreted.

2.Why are accounting principles important?

They ensure accuracy, consistency, transparency, and trust in financial reporting, helping stakeholders make informed decisions.

3.What is GAAP?

GAAP (Generally Accepted Accounting Principles) is a standardized framework of accounting rules used mainly in the U.S. for reliable financial reporting.

4.What is IFRS?

IFRS (International Financial Reporting Standards) is a global accounting framework that ensures consistency and comparability of financial statements across countries.

5.How do accounting principles help businesses?

They prevent errors, guide financial reporting, ensure compliance, and provide a clear picture of financial health for decision-making.