UAE Accounting Regulations Guide: A comprehensive guide on UAE accounting regulations, covering key laws, standards, reporting requirements, applications, and compliance steps for individuals and businesses operating in the United Arab Emirates.

The UAE Accounting Regulations Guide explains the comprehensive rules established to ensure transparency and accuracy in financial reporting across the UAE. Compliance with these regulations is essential for businesses and individuals, as it supports legal adherence, financial credibility, and audit readiness. The UAE Ministry of Finance and relevant authorities oversee the enforcement of these standards. UAE accounting practices are aligned with International Financial Reporting Standards (IFRS), ensuring consistency with global financial reporting norms and strengthening investor confidence.

Table of Contents

Key Accounting Standards in the UAE

The UAE Accounting Regulations Guide outlines strict accounting standards designed to ensure accuracy and consistency in financial reporting. The UAE primarily follows International Financial Reporting Standards (IFRS), aligning local practices with global benchmarks. These standards cover key areas such as financial statements, revenue recognition, leases, and taxation. Adhering to the UAE Accounting Regulations Guide helps businesses stay compliant, build investor confidence, and ensure smooth audit processes.

International Financial Reporting Standards (IFRS)

The UAE Accounting Regulations Guide highlights the widespread adoption of IFRS to standardize financial reporting and align UAE businesses with global practices. Listed companies are required to fully comply with IFRS, while non-listed companies may apply simplified standards based on their size and business activities.

Key IFRS standards commonly used in the UAE include IFRS 15 (Revenue from Contracts with Customers), IFRS 16 (Leases), IFRS 9 (Financial Instruments), and IFRS 17 (Insurance Contracts). Following these standards ensures transparency, comparability, and reliability in financial statements.

Generally Accepted Accounting Principles (GAAP)

In the UAE, GAAP refers to local accounting principles followed by certain businesses, primarily smaller or non-listed companies. Unlike IFRS, which is globally standardized, GAAP provides guidelines tailored to local regulatory and tax requirements.

Some industries, such as private companies, family-owned businesses, and specific financial institutions, may use local GAAP for reporting, especially if they are not obligated to adopt IFRS. Understanding the differences between GAAP and IFRS is important for compliance and accurate financial reporting.

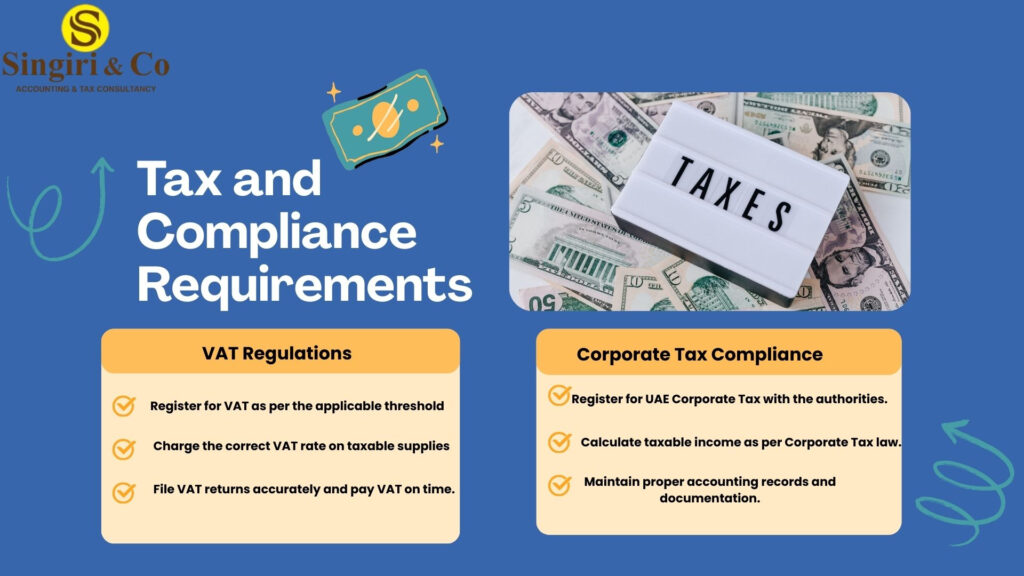

Tax and Compliance Requirements

The UAE Accounting Regulations Guide explains that businesses and individuals in the UAE must follow specific tax and compliance requirements to avoid penalties and maintain legal standing. The UAE imposes Value Added Tax (VAT) on most goods and services, while corporate tax applies to eligible businesses. Companies are required to maintain accurate financial records, file tax returns on time, and undergo audits when required. Adhering to these regulations ensures smooth business operations, regulatory compliance, and enhanced investor confidence

VAT Regulations

The UAE Accounting Regulations Guide states that businesses must register for VAT when their taxable supplies exceed the mandatory threshold set by the Federal Tax Authority (FTA). VAT-registered businesses are required to file periodic VAT returns and maintain detailed transaction records. Non-compliance, such as late registration or incorrect VAT filing, can lead to penalties, fines, or legal action. Following VAT regulations ensures smooth business operations and prevents financial or legal complications.

Corporate Tax Compliance

The UAE Accounting Regulations Guide explains that businesses subject to corporate tax must comply with regulations issued by the Federal Tax Authority. Companies are required to maintain accurate accounting records that clearly show income, expenses, and taxable profits. Timely filing of corporate tax returns, along with proper documentation such as financial statements and supporting schedules, is essential. Adhering to corporate tax requirements ensures legal compliance, avoids penalties, and promotes transparent financial reporting.

Financial Reporting and Audit Requirements

The UAE Accounting Regulations Guide states that UAE companies must prepare accurate financial statements in line with IFRS or applicable local GAAP, depending on their size and business nature. Publicly listed companies and larger private entities are generally required to undergo independent audits to confirm financial accuracy.

Maintaining proper accounting records, including ledgers, journals, and supporting documents, is essential for audit readiness. Regular financial reporting and audits promote transparency, regulatory compliance, and strong investor confidence.

Mandatory Financial Statements

UAE companies are required to prepare key financial statements, including the balance sheet, income statement, cash flow statement, and statement of changes in equity. These statements provide a complete overview of the company’s financial health and performance. Businesses must ensure that these reports are prepared annually and submitted within the timelines specified by regulatory authorities. Timely and accurate reporting supports compliance, audit readiness, and stakeholder confidence

External Audit Requirements

The UAE Accounting Regulations Guide explains that certain companies, including publicly listed entities, larger private firms, and businesses meeting prescribed thresholds, are required to have their financial statements audited by licensed external auditors. These auditors verify financial accuracy, ensure compliance with IFRS or applicable local GAAP, and provide assurance to stakeholders. External audits help identify errors or discrepancies and enhance the credibility and reliability of financial reporting.

Record-Keeping and Documentation

Businesses in the UAE are legally required to maintain proper bookkeeping records, including invoices, receipts, ledgers, and financial statements. These records must be preserved for a specified period as mandated by regulatory authorities to ensure transparency and audit readiness.

Maintaining organized and accurate documentation helps businesses meet tax and compliance requirements efficiently. Following best practices such as digital record storage, regular updates, and proper categorization improves financial management and reduces errors.

Record-Keeping Requirements and Best Practices:

- Maintain accurate books to comply with UAE tax laws, VAT rules, and audit requirements

- Retain financial records for the legally required period (minimum 5–7 years in the UAE)

- Use organized digital and physical filing for easy document retrieval

- Record transactions regularly to avoid errors and last-minute corrections

- Implement internal controls to ensure data accuracy and financial transparency

Penalties and Consequences of Non-Compliance

Failure to follow accounting and regulatory requirements in the UAE can result in fines for incorrect reporting, late submissions, or non-compliance with tax laws. Serious violations may impact business licenses, operational approvals, and overall credibility with authorities and investors.

Companies may also face audits, legal action, or financial restrictions. To rectify non-compliance, businesses should review records, correct errors, submit revised reports, and consult qualified accountants or auditors to ensure future compliance.

Consequences of Accounting Non-Compliance:

- Financial penalties for incorrect accounting or reporting

- Increased scrutiny from tax and regulatory authorities

- Risk of business license suspension or non-renewal

- Operational restrictions or temporary business disruption

- Damage to business reputation and stakeholder trust

Best Practices for UAE Businesses

UAE businesses should conduct regular reconciliations and account reviews to ensure financial accuracy and compliance. Using reliable accounting software helps streamline reporting, reduce errors, and meet regulatory requirements. Staying updated with changes in tax laws, IFRS, and compliance rules is essential for smooth operations. Consulting professional accountants or auditors provides expert guidance, improves financial management, and minimizes compliance risks.

Effective Accounting Practices for UAE Businesses:

- Regular reconciliation and review of accounts to ensure accuracy and detect discrepancies early

- Use of accounting software to simplify reporting and maintain UAE compliance

- Timely updates on regulatory and tax law changes

- Consultation with professional accountants for expert guidance and risk management

- Strong internal controls to support accurate and compliant financial reporting

Conclusion

UAE Accounting Regulations Guide provides a structured framework for accurate financial reporting, tax compliance, and transparency across businesses operating in the UAE. Continuous compliance with these rules helps organizations avoid penalties and maintain long-term operational stability. By following IFRS and local regulatory requirements outlined in the UAE Accounting Regulations Guide, businesses enhance credibility, support informed decision-making, and promote sustainable growth in the UAE market.

Businesses that prioritize proper accounting practices under the UAE Accounting Regulations Guide are better prepared for audits, investments, and expansion opportunities. Strong financial discipline also builds trust with stakeholders, regulators, and financial institutions, ensuring smooth business operations and regulatory confidence.

(FAQS)

1. What are UAE accounting regulations?

UAE accounting regulations define the rules and standards businesses must follow for financial reporting, bookkeeping, audits, and compliance with tax authorities in the UAE.

2. Which accounting standards are followed in the UAE?

Businesses in the UAE are required to follow International Financial Reporting Standards (IFRS) or IFRS for SMEs, depending on their size and turnover.

3. Who must comply with UAE accounting regulations?

All businesses operating in the UAE, including mainland companies, free zone entities, and foreign branches, must comply with UAE accounting regulations.

4. Is IFRS mandatory for UAE companies?

Yes, IFRS is mandatory for most UAE companies, while smaller entities may use IFRS for SMEs as permitted under UAE regulations.

5. How long should records be maintained under the UAE Accounting Regulations Guide?

As per the UAE Accounting Regulations Guide, accounting records must be retained for at least five years, while tax-related records may require longer retention.

6. Are audited financial statements required in the UAE?

Many UAE businesses, especially free zone companies and regulated entities, are required to submit audited financial statements annually

7. How do UAE accounting regulations impact corporate tax compliance?

Taxable income must be calculated based on financial statements prepared in accordance with IFRS or IFRS for SMEs under UAE accounting regulations.