Corporate Tax Return Filing in UAE

Introduction

The UAE Corporate Tax regime, introduced by the Federal Tax Authority (FTA), enhances fiscal transparency while keeping the UAE attractive for businesses. It applies to eligible companies and aligns with international tax standards without imposing heavy burdens. Compliance is essential to avoid penalties, maintain good standing, and build investor confidence. Businesses must register, determine their tax period, assess taxable income, and file returns on time. Early preparation ensures efficient management of obligations and long-term financial stability.Corporate Tax Return Filing in UAE

Key Points:

- Introduced to align the UAE with global tax and compliance standards

- Administered and regulated by the Federal Tax Authority (FTA)

Applies to most businesses operating in the UAE - Encourages transparency and proper financial reporting

- Helps businesses avoid penalties and legal risks

- Applicable from recent financial years based on the entity’s tax period

What is Corporate Tax Return Filing in UAE?

Corporate Tax Return Filing in the UAE is the process through which businesses report their taxable income, deductions, exemptions, and Corporate Tax liability to the Federal Tax Authority (FTA) for a specific tax period. It is a mandatory requirement under UAE Corporate Tax law and serves as an official record of a company’s financial performance. Filing ensures accurate calculation and payment of Corporate Tax, promotes transparency, and allows businesses to claim eligible exemptions, reliefs, and tax credits. The Federal Tax Authority (FTA) administers Corporate Tax, issues regulations and guidance, and manages the EmaraTax system for filing and compliance.

Key Aspects of Corporate Tax Return Filing in UAE

- Mandatory process for reporting taxable income and Corporate Tax liability

- Applicable to businesses and other taxable persons operating in the UAE

Ensures correct tax calculation and timely payment - Allows businesses to claim eligible deductions, exemptions, and reliefs

Regulated and monitored by the Federal Tax Authority (FTA)

Who Needs to File Corporate Tax Returns in the UAE?

Corporate Tax return filing in the UAE is mandatory for various taxable persons based on their business presence and activities. Mainland companies with a UAE commercial licence must file returns regardless of size or revenue. Free Zone entities, including those eligible for preferential tax treatment, must also file to demonstrate compliance. Branches of foreign companies operating in the UAE are required to file for their UAE operations. Individuals with commercial, professional, or industrial licences must file if their income exceeds the minimum taxable threshold. Filing ensures transparency and adherence to UAE Corporate Tax regulations set by the Federal Tax Authority (FTA).

Applicable Taxable Persons

- Mainland companies

- Free Zone entities

- Branches of foreign companies

- Individuals conducting business activities

- Entities meeting the minimum taxable income threshold

Entities Exempt from Corporate Tax Filing

Certain entities are exempt from Corporate Tax under UAE law due to their nature and activities. Public benefit entities approved by the relevant authorities are exempt as they operate for charitable or public welfare purposes.Corporate Tax Return Filing in UAE Government entities and government-controlled entities are generally exempt due to their sovereign functions. Businesses engaged in the extraction of natural resources are subject to Emirate-level taxation instead of Corporate Tax. Qualifying investment funds may also be exempt subject to specific conditions. Some exempt entities are still required to submit notifications or declarations to the Federal Tax Authority to confirm their exempt status.

Exempt Categories

- Public benefit entities

- Government and government-controlled entities

- Natural resource extraction businesses

- Qualifying investment funds

- Exempt entities with notification requirements

Corporate Tax Filing Mandatory in the UAE?

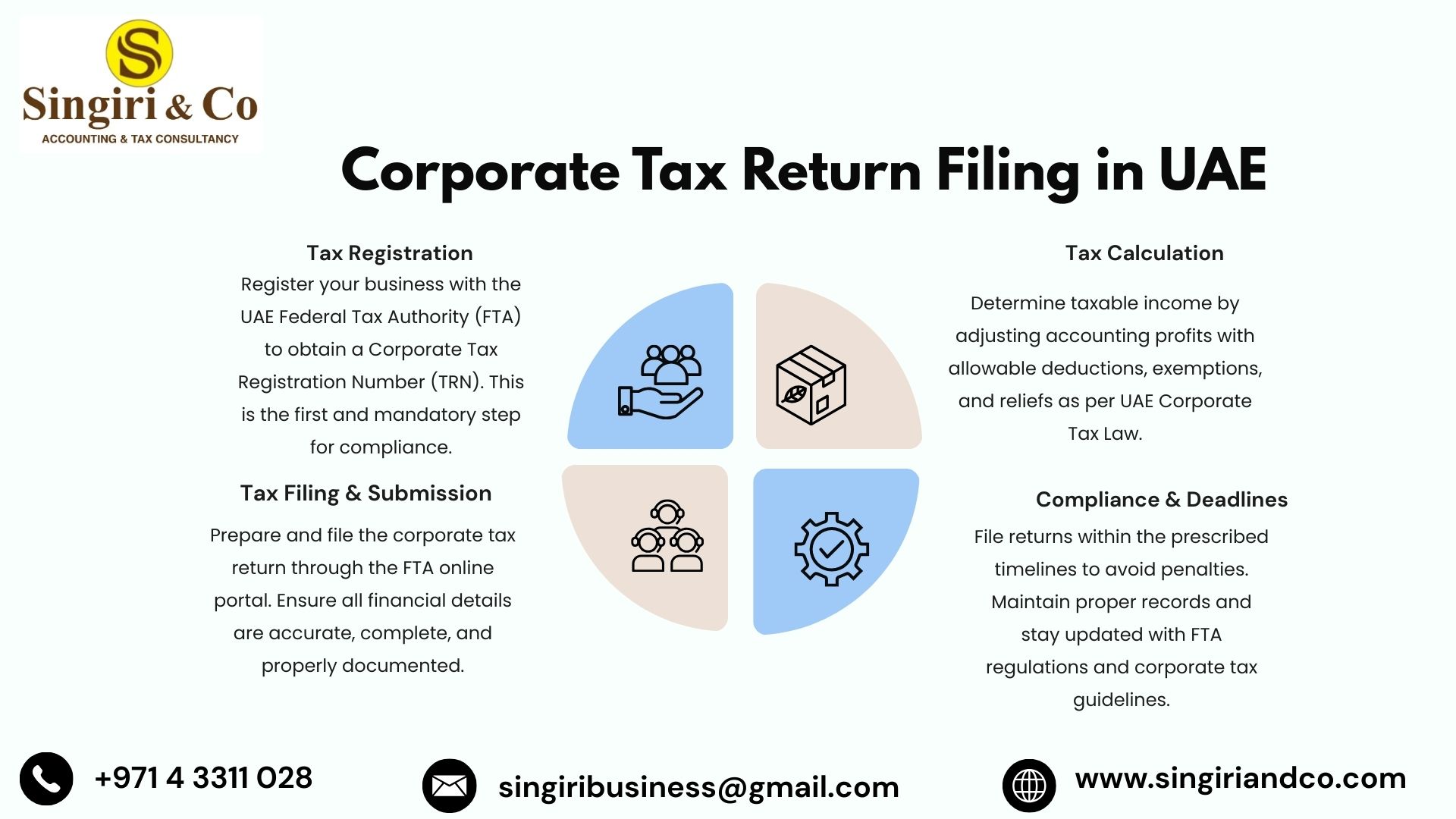

Corporate Tax filing in the UAE follows a structured and compliant process for businesses. Corporate Tax filing begins with registration with the Federal Tax Authority (FTA) to obtain a valid tax registration certificate. Proper documentation and accurate financial statements are essential for correct Corporate Tax filing, as they help determine taxable income under UAE Corporate Tax regulations. The Corporate Tax filing return is submitted electronically through the EmaraTax portal within the prescribed deadline, and any Corporate Tax liability must be paid on time. After Corporate Tax filing, businesses must maintain records for future audits or reviews by the FTA, ensuring ongoing compliance and reduced risk of penalties.

Mandatory Filing Requirements

- Filing required for all registered taxable persons

- Mandatory even when there is no taxable income

- Non-filing may lead to penalties and legal consequences

Corporate Tax Filing for Free Zone Entities

All Free Zone entities operating in the UAE are required to file Corporate Tax returns, even if they qualify for tax exemptions. Filing ensures that companies report their income and financial details accurately to the Federal Tax Authority (FTA) and remain compliant with UAE Corporate Tax regulations. Qualifying Free Zone Persons (QFZPs) may benefit from a 0% Corporate Tax rate on qualifying income if they meet specific requirements, including maintaining adequate economic substance in the UAE, adhering to transfer pricing rules, and ensuring that their income qualifies under the Corporate Tax law. Companies must also separate qualifying and non-qualifying income where applicable. Even when a 0% tax rate applies, submitting a Corporate Tax Return Filing in UAE is mandatory. Returns must provide accurate financial information and tax calculations. Failure to comply may result in penalties or loss of tax benefits. Timely and accurate filing demonstrates continued eligibility for Free Zone tax incentives, promotes transparency, and ensures ongoing compliance with Corporate Tax Return Filing in UAE

7 Key Rules for Corporate Tax Return Filing in UAE Free Zones

- Applicable to all Free Zone companies

- QFZPs eligible for prefere

- Key Deadlines

- Tax period determined based on financial year end

- Corporate Tax return filing deadline within 9 months

- Corporate Tax payment deadline aligned with filing

- Penalties applicable for late filing or late payment

Documents Required for Corporate Tax Return Filing

Accurate documentation is crucial for Corporate Tax compliance in the UAE. Businesses must maintain valid trade licences and Corporate Tax registration certificates at all times. Financial records, including audited or management financial statements, general ledger, and trial balance, must be properly prepared and up to date. Bank statements, revenue records, and expense records should also be maintained systematically. Fixed asset registers are required to track company assets accurately. VAT records must be kept if applicable to the business activities. Corporate Tax Return Filing in UAE Transfer pricing documentation is necessary for companies engaged in related-party transactions. Supporting schedules, reconciliations, and disclosures must be maintained to ensure transparency. Proper documentation helps businesses calculate taxes correctly and avoid errors. It also ensures audit readiness and smooth interactions with the Federal Tax Authority. Maintaining organized records ultimately safeguards the business from penalties and compliance risks.

Required Documents

- Trade licence and registration details

- Corporate Tax Registration Certificate

- Audited or management financial statements

- General ledger and trial balance

- Bank statements

- Revenue and expense records

- Fixed asset register

- VAT records if applicable

- Transfer pricing documentation if applicable

- Supporting schedules and disclosures

Procedure for Corporate Tax Return Filing in UAE

Corporate Tax filing in the UAE follows a structured and systematic process. Businesses must begin by registering with the Federal Tax Authority (FTA) to obtain a Corporate Tax registration certificate. All required documents, including financial statements and supporting records, should be properly collected and reviewed. Taxable income is then calculated by applying eligible deductions, exemptions, and reliefs as per UAE Corporate Tax regulations. The return must be filed electronically through the EmaraTax portal within the prescribed deadline, and any tax liability must be paid on time. After filing, businesses are required to maintain records for future audits or FTA assessments. Following each step carefully ensures compliance, accuracy, and reduced risk of penalties.Corporate Tax Return Filing in UAE

Filing Process Steps

- Step 1 – Corporate Tax Registration

- Step 2 – Gather Required Documents

- Step 3 – Prepare Financial Statements

- Step 4 – Calculate Taxable Income

- Step 5 – Apply Exemptions and Reliefs

- Step 6 – File Return via EmaraTax Portal

- Step 7 – Pay Corporate Tax Liability

- Step 8 – Maintain Records for Audit

Common Mistakes to Avoid

Many businesses face penalties due to avoidable errors in Corporate Tax compliance. Missing registration or filing deadlines is a frequent issue that triggers fines from the Federal Tax Authority (FTA). Submitting incorrect or incomplete financial information can result in reassessments and additional penalties. Ignoring transfer pricing requirements for related-party transactions exposes companies to compliance risks. Some businesses mistakenly assume that being exempt from tax removes the obligation to file returns, which can lead to non-compliance penalties. Poor record keeping, such as missing invoices, bank statements, or supporting schedules, further increases the likelihood of audits and fines. Ensuring accurate, timely, and complete filing is essential to avoid these common mistakes.Corporate Tax Return Filing in UAE Corporate Tax Return Filing in UAE

Frequent Errors

- Missing registration deadlines

- Filing incorrect financial data

- Ignoring transfer pricing requirements

- Assuming exemption means no filing

- Poor record keeping

Penalties for Non-Compliance

The Federal Tax Authority (FTA) imposes penalties for non-compliance with Corporate Tax regulations. Penalties may arise due to late registration, which occurs when a business fails to register within the prescribed timelines.Corporate Tax Return Filing in UAE Late filing of Corporate Tax returns can also trigger fines and interest on unpaid tax. Submission of incorrect or incomplete returns may result in reassessments and additional penalties. Failure to maintain proper records, including financial statements, invoices, and supporting documentation, exposes businesses to further fines and audit risks. These penalties can significantly impact a company’s finances, disrupt operations, and harm its reputation with regulators and stakeholders.

Penalty Categories

- Late registration penalties

- Late filing penalties

- Incorrect return penalties

- Failure to maintain records

How Professional Corporate Tax Services Help

Professional Corporate Tax services provide comprehensive support to businesses throughout the entire compliance process. These services include assistance with Corporate Tax registration, accurate preparation and filing of returns, and thorough compliance reviews to identify potential risks. Experts also offer transfer pricing advisory and implement tax planning and optimization strategies to minimize liabilities. Additionally, professional service providers act as liaisons with the Federal Tax Authority (FTA), ensuring smooth communication and guidance. They offer crucial support during audits and assessments, helping businesses address queries, provide required documentation, and maintain compliance. Utilizing professional services enhances accuracy, reduces the risk of penalties, and ensures timely and efficient Corporate Tax management.Corporate Tax Return Filing in UAE

Service Advantages

- End-to-end filing support

- Compliance review and risk assessment

- Transfer pricing advisory

- Tax planning and optimization

- FTA liaison and audit support

Conclusion

Corporate Tax filing in the UAE is a mandatory requirement for all taxable persons and businesses operating in the country. Filing returns accurately and on time is crucial to avoid penalties, ensure compliance with regulatory obligations, and maintain smooth business operations. Proper Corporate Tax compliance also strengthens credibility with stakeholders and supports long-term financial planning. Engaging experienced tax professionals can assist businesses in navigating the filing process efficiently, applying relevant exemptions and reliefs, and maintaining adherence to UAE tax regulations. Professional guidance ensures timely submission, minimizes errors, and provides support during audits or assessments by the Federal Tax Authority (FTA). Overall, accurate and timely Corporate Tax filing is essential for lawful, efficient, and sustainable business operations in the UAE.Corporate Tax Return Filing in UAE

(FAQs)

1. What is Corporate Tax?

A tax on business income in the UAE, administered by the Federal Tax Authority.

It ensures businesses report and pay taxes accurately.

2. Who must file?

Mainland companies, Free Zone entities, foreign branches, and licensed individuals.

All taxable persons must comply, regardless of income.

3. Are Free Zone companies exempt?

No. They must file even if they qualify for 0% tax.

They must meet conditions like substance and reporting requirements.

4. Filing deadline?

Corporate Tax returns must be filed within 9 months of the financial year end.

Payment of tax liability is due by the same deadline.

5. Required documents?

Trade licence, tax registration, financial statements, ledgers, bank statements, and supporting schedules.

VAT and transfer pricing documents are needed if applicable.

6. Penalties for late filing?

Fines, administrative penalties, and FTA scrutiny apply.

Non-compliance can affect business reputation and finances.

7. How is taxable income calculated?

Revenue minus allowable expenses, after applying exemptions and reliefs.

Accurate calculation ensures correct tax liability.

8. Corporate Tax rates?

0% for income up to threshold, 9% for income above threshold.

Large multinational groups may follow special global tax rules.Corporate Tax Return Filing in UAE

9. Can professionals help?

Yes, they assist with filing, compliance checks, tax planning, and audits.

They also liaise with the FTA on behalf of businesses.

10. How long to keep records?

Typically 5 years for audit and FTA review purposes.

Proper records prevent penalties and support compliance.